Why small communities will adopt first and scale fastest

Humanoid robots are no longer a futuristic concept. In 2026, they crossed into real deployment across factories, logistics, and controlled environments. What matters now is not spectacle, but utility.

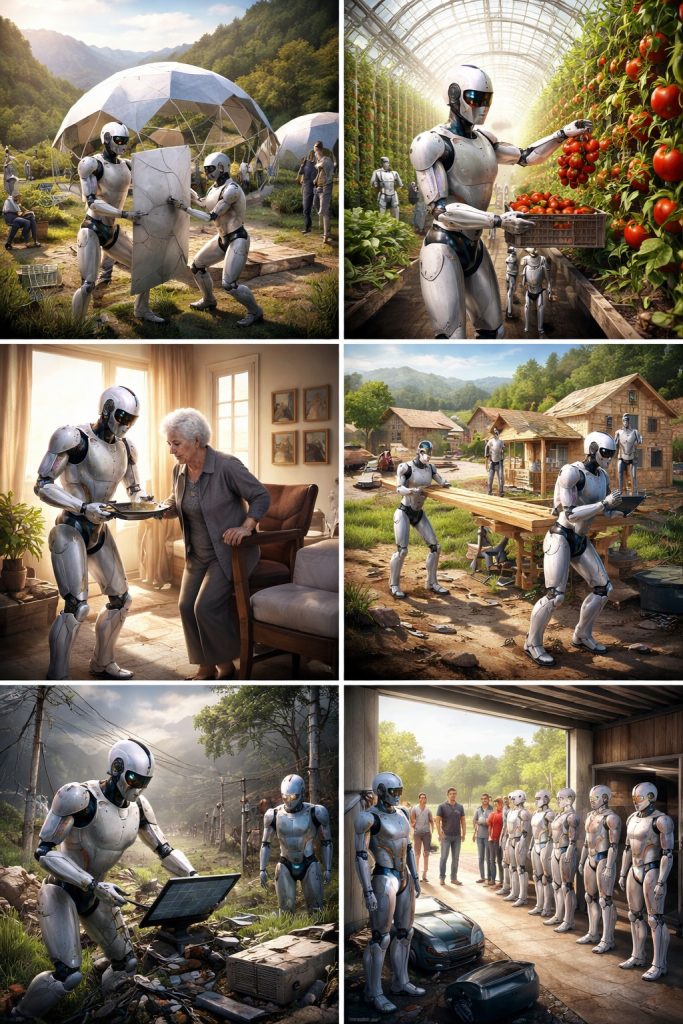

For regenerative communities, modular housing builders like Geoship, and rural regions facing labor shortages, humanoids represent a new class of infrastructure. They are mobile labor, available on demand, improving over time, and increasingly affordable through service models.

This shift is not about robots doing housework. It is about unlocking capacity in housing assembly, food production, and elder support where human labor is scarce, expensive, or stretched thin.

Housing assembly: humanoids as force multipliers, not replacements

Humanoids will not replace skilled builders. They remove the bottlenecks that slow construction and drive costs.

In modular and regenerative housing systems, the highest friction comes from repetitive, physically demanding tasks:

- Material staging and sequencing

- Carrying and holding components in tight spaces

- Tool handling, cleanup, and site reset

- Continuous visual documentation for quality control

Humanoids already perform these tasks reliably in industrial environments. Applied to housing, this means faster assembly, smaller crews, fewer injuries, and predictable timelines. For companies like Geoship, humanoids fit naturally into factory workflows and on-site installation without redesigning the entire build process.

Food production: local abundance without large labor pools

Modern food systems fail when staffing fails. Humanoids change the economics of local production.

In greenhouses, vertical farms, and processing spaces, humanoids can support:

- Seeding, transplanting, and harvesting logistics

- Packing, palletizing, and cold-chain handling

- Cleaning and sanitation routines

- Night shift continuity

- Emergency response to equipment issues

This allows small and rural communities to operate high-tech food infrastructure without importing large workforces. Food sovereignty becomes operational, not aspirational.

Aging in place: independence infrastructure

The fastest growing use case will not be cleaning. It will be supporting independence.

Humanoids will help older adults stay in their homes longer by assisting with:

- Mobility support and fall-risk tasks

- Medication and routine prompting

- Light meal preparation

- Physically demanding household tasks

- Telepresence for families and clinicians with physical capability

This reduces caregiver burnout and delays costly transitions into institutional care.

The real business model: Humanoid as a Service

Most communities will not buy humanoids outright. They will rent capability.

Humanoid fleets will operate like shared mobility:

- Monthly subscriptions per robot

- Hourly dispatch for peak needs

- Regional fleets shared across communities

- Remote expert supervision when needed

Small and rural communities will adopt first because workflows are clearer, trust is higher, and labor shortages are more acute.

Why this scales faster than people expect

Several underappreciated forces accelerate adoption:

- Teleoperation lets one skilled worker supervise many robots

- Insurance and task standardization unlock deployment at scale

- Buildings will be designed to be humanoid-maintainable from day one

- Disaster response and climate recovery create immediate public value

- Co-op and community ownership models keep benefits local

Humanoids become resilience infrastructure, not luxury technology.

Humanoid models to watch

USA

Boston Dynamics Atlas (all-electric): industrial-first, Hyundai scaling plans discussed publicly.

Figure (Figure 02, moving to newer generations): reported factory deployment metrics with BMW.

Agility Robotics Digit: commercial logistics deployments, reporting large tote-move milestones.

Apptronik Apollo: production and deployment focus, with public funding and commercial test partners mentioned.

Tesla Optimus: high-visibility effort, with Tesla and Musk signaling scaling intent. Details tend to be less concrete than others, but it drives public attention and talent flows.

Canada

Sanctuary AI Phoenix: Canadian humanoid positioning around dexterous work in real environments.

Europe

NEURA Robotics 4NE1 (Germany): positioned explicitly for work and life, with published materials and a detailed datasheet.

1X NEO (Norway and US): home-focused approach plus subscription-style pricing and remote supervision model.

Engineered Arts Ameca (UK): best known for interaction and expressive communication. More front-of-house today, but important for civic engagement, education, and community adoption.

China

UBTECH Walker S1: positioned for factory handling and integrated logistics coordination, with claims of real factory applications.

Unitree H1: mass-market aggressive pricing, fast iteration, strong locomotion narrative.

Fourier Intelligence GR-1: marketed as a general-purpose humanoid platform with published product materials.

Futurescape: the abundance arc before 2030!

2026 to 2027: humanoids become useful employees, not novelties

Most deployments are single-role: moving, staging, basic handling

Autonomy improves fast via scale learning across fleets

Subscription and fleet models become normal, especially for smaller operators

2027 to 2028: construction and logistics become robot-native

Factories and build sites redesign workflows around humanoids

Housing assembly becomes faster and more predictable as handling bottlenecks disappear

Night-shift and continuous operations become viable

2028 to 2030: community-scale compounding

Rural communities operate capability fleets across housing, food, and elder support

Local economies gain new layers: robot dispatch, maintenance, training, workflow design

The biggest unlock is not chores. It is new small businesses that were impossible due to labor constraints